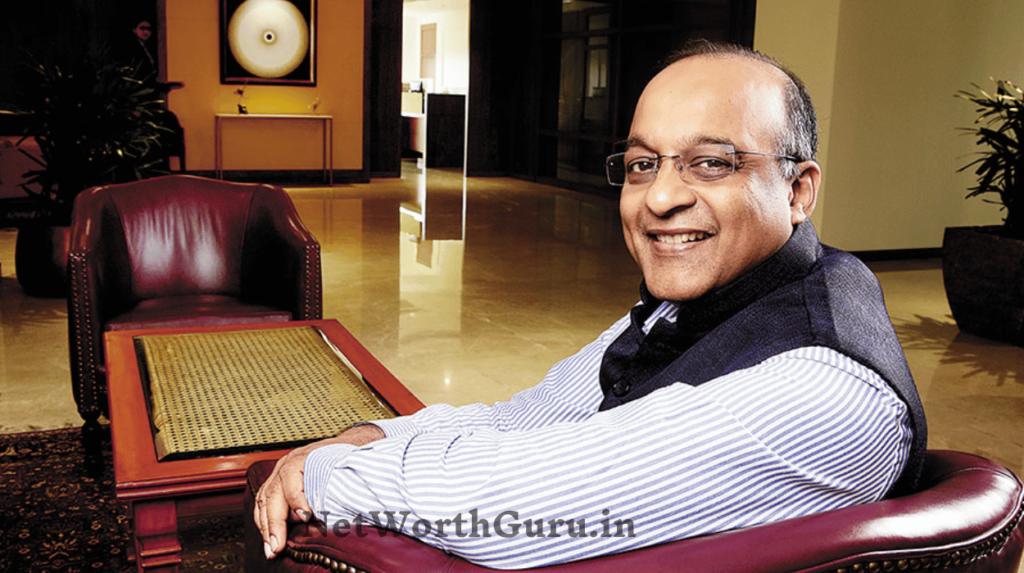

Sashidhar Jagdishan Net Worth : Sashidhar Jagdishan, the Managing Director and CEO of HDFC Bank, is a prominent figure in India’s banking sector.

Under his leadership, HDFC Bank has achieved remarkable growth, reinforcing its position as one of the leading private sector banks in India.

This blog post aims to delve into the net worth of Sashidhar Jagdishan, analyzing various aspects of his business ventures, investment strategies, and overall impact on the banking industry.

Breakdown of Net Worth by Business Segment

Sashidhar Jagdishan’s net worth is primarily attributed to his successful tenure at HDFC Bank. As of 2024, estimates suggest his net worth is approximately $15 million, encompassing his salary, bonuses, stock options, and other business ventures. Below is a table illustrating the estimated breakdown of his net worth:

| Segment | Estimated Value |

|---|---|

| Salary | $2 million |

| Stock Options | $5 million |

| Investments in Startups | $3 million |

| Real Estate Holdings | $3 million |

| Other Ventures | $2 million |

| Total Net Worth | $15 million |

Sashidhar Jagdishan Key Businesses and Ventures

Jagdishan’s most significant venture is HDFC Bank, which he joined in 1996. Over the years, he has held various leadership roles, shaping the bank’s strategic direction. Beyond HDFC Bank, he has invested in fintech startups and other financial institutions, promoting innovation within the industry.

Also Read : Aman Gupta Net Worth : The Rise of a Business Mogul and Philanthropist

Sashidhar Jagdishan Net Worth In Rupees

Sashidhar Jagdishan, the Managing Director and CEO of HDFC Bank, had a remuneration package of ₹10.57 crore for the financial year 2022-23. This marked a significant 62% increase from his previous year’s earnings of ₹6.51 crore. His compensation includes a basic salary, allowances, and performance bonuses.

While specific details on his total net worth in rupees aren’t publicly disclosed, Jagdishan is considered one of the highest-paid banking executives in India.

With his leadership in one of India’s largest private banks, his overall financial standing is likely considerable, tied to salary, investments, and potential stock options within HDFC Bank.

Sashidhar Jagdishan Revenue Streams from Business Operations

The primary revenue streams for Jagdishan’s business operations at HDFC Bank include:

- Interest Income: Profits generated from loans and credit products.

- Fees and Commissions: Earnings from services like account maintenance, fund management, and transaction processing.

- Investment Income: Returns from the bank’s investment portfolio.

- Foreign Exchange Operations: Revenue from currency trading and hedging services.

Sashidhar Jagdishan Business Strategies and Tactics

Jagdishan has employed several strategies to drive HDFC Bank’s growth:

- Digital Transformation: Emphasizing the adoption of digital banking services to enhance customer experience.

- Diversification: Expanding product offerings beyond traditional banking services, including insurance and asset management.

- Customer-Centric Approach: Focusing on understanding and fulfilling customer needs, leading to high customer retention rates.

Sashidhar Jagdishan Major Business Investments

Sashidhar Jagdishan has made strategic investments in various sectors, including:

- Fintech Startups: Investing in technology-driven financial solutions to stay ahead in the competitive market.

- Infrastructure Projects: Engaging in financing projects that promote economic growth and development in India.

Sashidhar Jagdishan IPO, Mergers, and Acquisitions

Under Jagdishan’s leadership, HDFC Bank has seen significant growth through:

- Successful IPOs: HDFC Bank went public in 1995, and its shares have consistently performed well in the stock market.

- Strategic Acquisitions: The bank has acquired several smaller banks and financial institutions to expand its customer base and service offerings.

Sashidhar Jagdishan Business Innovation and Expansion

Innovation has been at the forefront of HDFC Bank’s strategy, driven by Jagdishan’s vision. Notable innovations include:

- Digital Banking Platforms: Launching user-friendly mobile and online banking services.

- AI and Machine Learning: Implementing advanced technologies to enhance operational efficiency and risk management.

Also Read : Suraj Nambiar Net Worth : From Entrepreneur to Millionaire

Sashidhar Jagdishan Business Failures and Setbacks (and Recovery)

Like any business leader, Jagdishan has faced challenges. For instance, the COVID-19 pandemic posed significant hurdles for the banking sector. However, HDFC Bank swiftly adapted by enhancing its digital capabilities, allowing it to recover quickly and maintain profitability.

Sashidhar Jagdishan Influence on Industry and Market

Jagdishan’s leadership has not only impacted HDFC Bank but also the entire Indian banking landscape. His commitment to innovation and customer service has set benchmarks for other financial institutions, fostering a culture of excellence.

Sashidhar Jagdishan Business Partnerships and Collaborations

Collaborative efforts with fintech companies and technology providers have allowed HDFC Bank to expand its service offerings and enhance customer experience. Partnerships with companies like Paytm and PhonePe have strengthened its digital payment services.

Sashidhar Jagdishan Business Awards and Recognition

Jagdishan and HDFC Bank have received numerous accolades, including:

- Best Private Bank: Awarded by several financial publications.

- Excellence in Customer Service: Recognized for outstanding service quality in the banking sector.

Sashidhar Jagdishan Impact of Economic Factors on Business and Net Worth

Economic conditions, such as interest rates and inflation, significantly influence HDFC Bank’s operations and Jagdishan’s net worth. A stable economy typically supports bank profitability, whereas economic downturns can pose risks.

Sashidhar Jagdishan Global Business Influence

Jagdishan’s leadership extends beyond India. HDFC Bank’s initiatives in international markets have positioned it as a key player in the global banking sector, with interests in regions like the Middle East and Southeast Asia.

Also Read : Natarajan Chandrasekaran Net Worth : The Man Behind TCS’s Success!

Sashidhar Jagdishan Succession Planning and Business Legacy

Jagdishan’s focus on succession planning ensures that HDFC Bank continues to thrive even after his tenure. By mentoring future leaders and fostering a strong corporate culture, he aims to leave a lasting legacy.

Philanthropy and Social Contributions

Sashidhar Jagdishan is committed to social causes, and HDFC Bank actively engages in various philanthropic efforts, including:

- Financial Literacy Programs: Initiatives aimed at educating underprivileged communities about banking and financial management.

- Sustainable Development Projects: Supporting environmental sustainability through funding and resources.

Sashidhar Jagdishan Car Collection

Jagdishan enjoys a luxurious lifestyle, which includes a collection of high-end vehicles. While specific details of his car collection are private, it is known that he favors brands like BMW and Audi, reflecting his taste for sophistication and quality.

Sashidhar Jagdishan Real Estate and Properties Owned

Jagdishan has made strategic real estate investments, owning properties in prime locations across major cities in India. This portfolio contributes significantly to his overall net worth, showcasing his understanding of investment diversification.

Sashidhar Jagdishan Lifestyle and Spending Habits

As a high-profile executive, Sashidhar Jagdishan leads a lifestyle that mirrors his success. He values experiences over material possessions, often engaging in travel and cultural experiences that broaden his perspectives.

Legacy and Influence

Sashidhar Jagdishan’s legacy is defined by his contributions to HDFC Bank and the Indian banking industry. His emphasis on innovation, customer service, and ethical business practices has inspired many aspiring entrepreneurs and leaders in the financial sector.

Sashidhar Jagdishan Net Worth FAQ

What is Sashidhar Jagdishan’s current position at HDFC Bank?

Sashidhar Jagdishan is the Managing Director and Chief Executive Officer (CEO) of HDFC Bank. He has held this position since October 2020, following the retirement of the previous CEO, Aditya Puri.

What strategies has Jagdishan implemented to drive HDFC Bank’s growth?

Sashidhar Jagdishan has focused on several key strategies to drive growth at HDFC Bank, including digital transformation, diversification of services beyond traditional banking, and a strong customer-centric approach. His emphasis on enhancing digital banking capabilities has significantly improved customer experience and operational efficiency.

How has Sashidhar Jagdishan contributed to HDFC Bank’s innovation?

Under Jagdishan’s leadership, HDFC Bank has invested in advanced technologies such as artificial intelligence and machine learning to enhance its banking services. The bank has also launched user-friendly digital platforms, making banking more accessible and efficient for customers.

What philanthropic initiatives has Sashidhar Jagdishan and HDFC Bank undertaken?

Jagdishan and HDFC Bank are involved in several philanthropic initiatives, including financial literacy programs aimed at educating underprivileged communities about banking and financial management. The bank also supports sustainable development projects that focus on environmental sustainability.

How has Jagdishan’s leadership influenced the Indian banking sector?

Sashidhar Jagdishan’s leadership has set benchmarks for excellence within the Indian banking sector. His commitment to innovation and high-quality customer service has influenced other financial institutions to adopt similar practices, fostering a competitive environment that prioritizes customer satisfaction and technological advancement.

Who is Sashidhar Jagdishan?

Sashidhar Jagdishan is the Managing Director and CEO of HDFC Bank, one of India’s largest private banks. He joined the bank in 1996 and has held various leadership roles, including Group Head overseeing finance and HR. He became CEO in 2020 and played a crucial role in the merger of HDFC Ltd. and HDFC Bank in 2023

HDFC Bank ceo salary

Sashidhar Jagdishan, CEO of HDFC Bank, earned a salary package of ₹10.57 crore for the financial year 2022-23. This marked a 62% increase from the previous year’s ₹6.51 crore. His remuneration includes his base salary, allowances, and performance bonuses

One thought on “Sashidhar Jagdishan Net Worth : The Man Behind india Money”